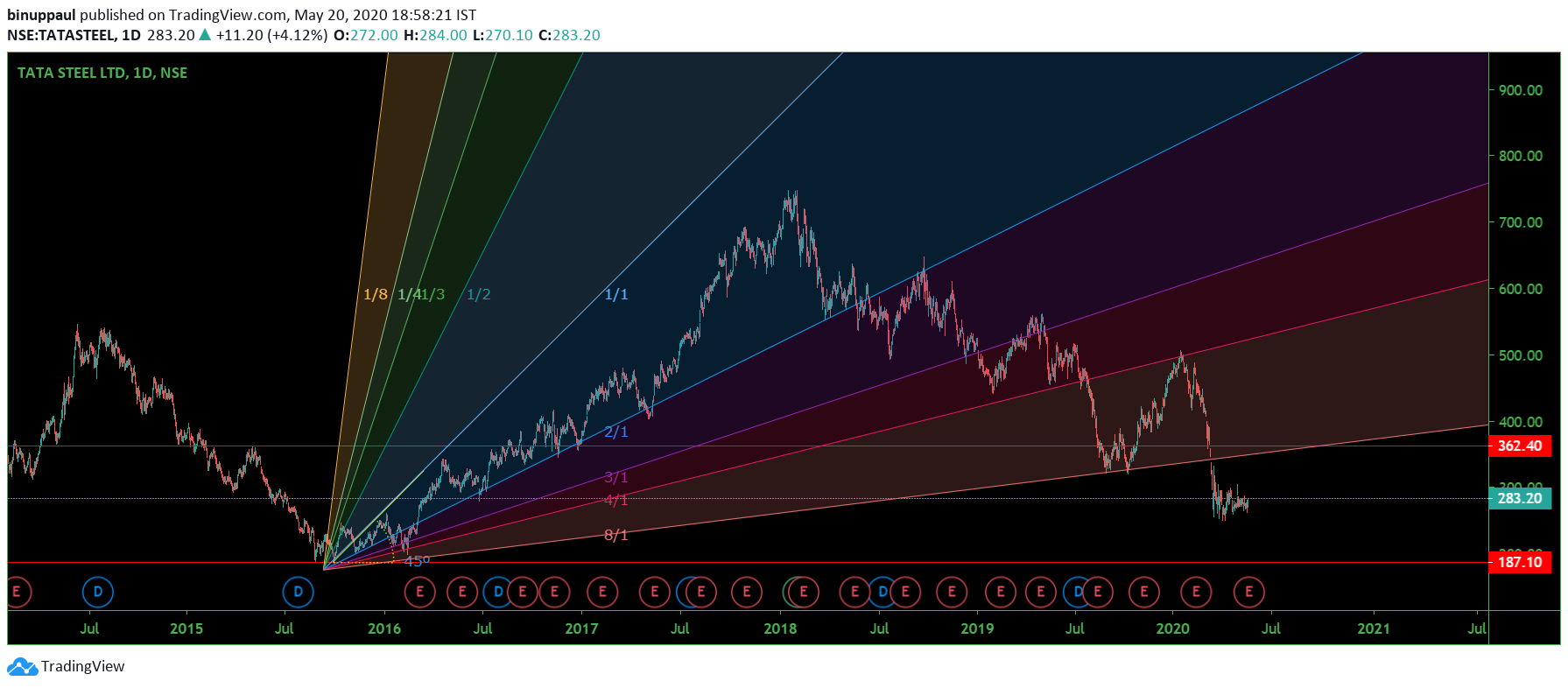

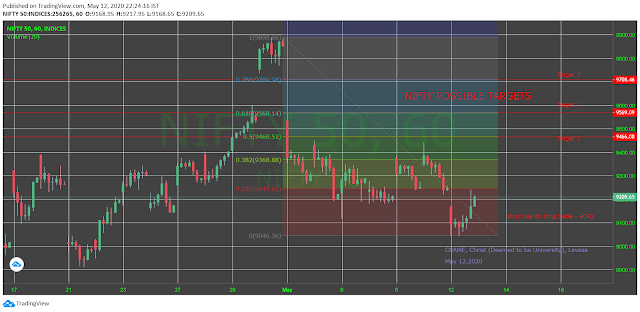

CRAME NOTE : NIFTY JUNE SERIES- POSSIBLE BEARISH BUTTERFLY IN THE MAKING ?

Dear Christite, Here is the latest analysis about Indian stock market from Center for Research in Asset Markets and Economy (CRAME), Christ (Deemed to be University) Lavasa. NIFTY could be in the process of making a bearish butterfly. Ratio based traders may find the pattern interesting as it emerges. The completion of the pattern requires confirmation at three critical price ranges as mentioned in the chart. If the pattern comes to fruition the index may test 9640-9660 levels and may go down to 9360-9330 levels and then go on to 10130-10170 levels to complete the pattern. It must be borne in mind that this post is looking at a possible pattern formation and additional filters need to be used to confirm trade entry levels. If the pattern gets completed in June, the series can witness quite volatile sessions. DISCLAIMER The content provided in CRAME blog is for educational purposes only. CRAME or the analyst(s) do(es) not assume any responsibility for the financial decisions/actions ma