Session on Stock Market Data Analysis

The session was engaged by Dr Shrutika Mishra who gave her insights on the topic “Option Trading For Beginners”. The introduction was given by Prof Pramila R M who introduced the speaker to the students. The purpose of this session was to provide an overview of factors that should be considered while Trading in the Stock Market.

Dr Shrutika Mishra started the session by giving a disclaimer about the risks involved in trading. She then distinguished the features between Investing and Trading. She proceeded further by clarifying why a trader can’t buy private companies shares but can buy the shares of private sectors which is because the private companies cannot be listed under SEBI but the private sector can. She gave some explanation about commodity markets and gave various examples.

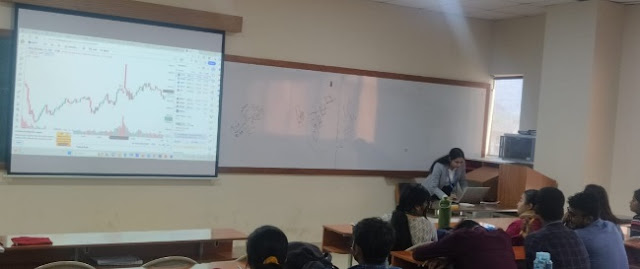

She explained the concept of Derivative contract and discussed its various types such as Forward Contract, Swaps Contract, Future Contract and Option Contract. She gave examples for each type and explained each type descriptively. She elaborated on why only Future and Option contracts are widely accepted in Intraday. She proceeded further by doing graphical analysis of the live stock market. Before doing the analysis, she explained the structure of a candle which is used in a candlestick graph. She explained the nature of a bullish candle and a bearish candle. She gave a clear explanation of various aspects of the graph and how it can be adjusted and modified according to the user's need.

She advised the interested students to trade in Intraday only for 30 seconds using various strategies. She explained three strategies to analyze the stock market which were Morning strategy analysis, Inside candle strategy and exponential moving strategy. She explained each strategy descriptively and demonstrated each strategy on the live candlestick graph.

She advised the students to use Morning Strategy Analysis and Inside candle strategy while trading as they are the most effective and easier strategy as compared to Exponential moving strategy. In Morning Strategy Analysis, she explained the concept of 15 minute candles where an analyst can predict the status of the market for 15 seconds using 3 candles of 5 minutes each at the beginning of the day. In Inside candle strategy, she explained how an analyst can estimate the status of a market if a candle is fully covered by the previous candle and used the live candlestick graph to demonstrate.

In conclusion, she advised students to get used to loss while trading as the Stock market can be very volatile and unpredictable at times and she also gave a warning as to trade only for a little time as there is a lot of risk involved and it requires a lot of patience.

After explaining and clearing the doubts of the students, Dr Shrutika Mishra concluded her talk. The session ended with a vote of thanks given by Priyanshu Kumar (Second Year Bsc Economics and Analytics).

Comments

Post a Comment